Since 1 January 2019 there has been a new reporting obligation for self-employed persons in Portugal. Indeed, a new mandatory quarterly declaration must be sent to the social security system in January, April, July and October, thus making it possible to calculate the amount of the contributions that the freelance must pay. The amount of social security taxes as a self-employed person in Portugal is now calculated each quarter according to the income obtaining over the previous 3 months. This social security declaration is made directly on the website Segurança Social Direita. How to complete your self-employed worker declaration in Portugal ? How to calculate social security contributions as a freelancer ? Lisbob, expats assistant in Portugal, tells you all about the quarterly income statement to the Portuguese Social Security.

This new mandatory declaration is for all self-employed workers in Portugal

Here is a step-by-step guide to completing and submitting your quarterly statement to Portuguese Social Security:

1. Access your personal area on the social security site Segurança Social DIreita

The quarterly social security declaration must be made exclusively via the Segurança Social Direita website. If you are not registered yet, this will be your first step. You must request an access code that will be sent to you by mail.

2. Click on "Save Declaration" (Registar declaração) in your personal space.

3. Choose "Save the quarterly report" (Registar declaração trimestral)

4. Income to be reported (Rendimentos a declarer)

On this page, you must indicate if you have income to report for the last quarter. The information must be completed for each of the last 3 months. If you have received income as a self-employed person and as an employee, you only have to enter your income from your freelance activity in Portugal.

If you have income to report, select "Yes" and "Next step"

If you did not have any income during the last quarter, click on "No". If you do not have a quarterly income to report, your statement ends here.

5. Information on the income obtained

If you have received income as a self-employed person in the last 3 months, you must then enter the values of the self-employed according to their origin (service provision, sale, local accommodation, etc.) for each of the last 3 months.

As you complete the figures, they are automatically added together, giving the "Total of the quarter", ie the total income taken into account for the calculation of the contribution to the Portuguese social security.

When you are done filling out this page, go to "Next Step".

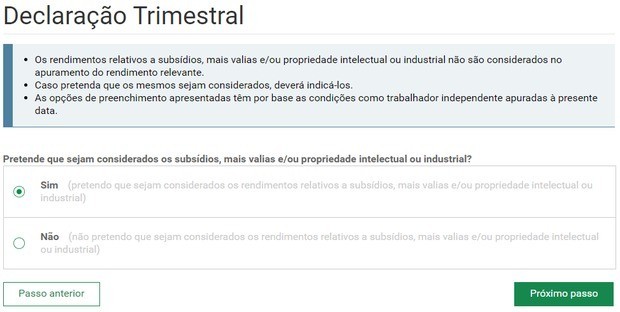

6. Allowances, capital gains and / or intellectual or industrial property

Income related to allowances (unemployment or other), capital gains and / or intellectual or industrial property are not taken into account for the determination of the income concerned. If you want them to be taken into account when calculating social security contributions, you can indicate this in the following table.

If you choose to take these returns into account when calculating your auto entrepreneur contributions, you will need to report them in the table below.

7. Estimated monthly amount of social security contribution

Finally, in the last step, you are immediately informed of the amount of the monthly contribution planned for the next 3 months. As a freelance worker in Portugal you will have to pay the same amount for the 3 months following this declaration.

You can also choose the variation of your contribution, a value of 25% higher or lower than the expected amount, according to your needs. Be careful not to abuse this maneuver because the Portuguese tax authorities control income earned as a self-employed person.

Finally, do not forget to click on "Issue Declaration" (Entregar Declaração) to complete the transmission process.

If necessary, you can modify the declared values by submitting a new declaration. It must be taken into account that the last declaration submitted until the last day of January will be the one used for calculating your social security taxes as a freelancer in Portugal.

You can also consult the monthly contributions directly in your personal space of the social security website